WESTMONT Magazine

Westmont publishes the Westmont magazine each semester to chronicle the college's journey. Each issue highlights the academic, athletic, creative, and cultural achievements of Westmont students, professors and staff. It also features stories about the college's commitment to diversity, its impact on the local community, and its global reach. This website includes links to stories from magazines dating back to 1995.

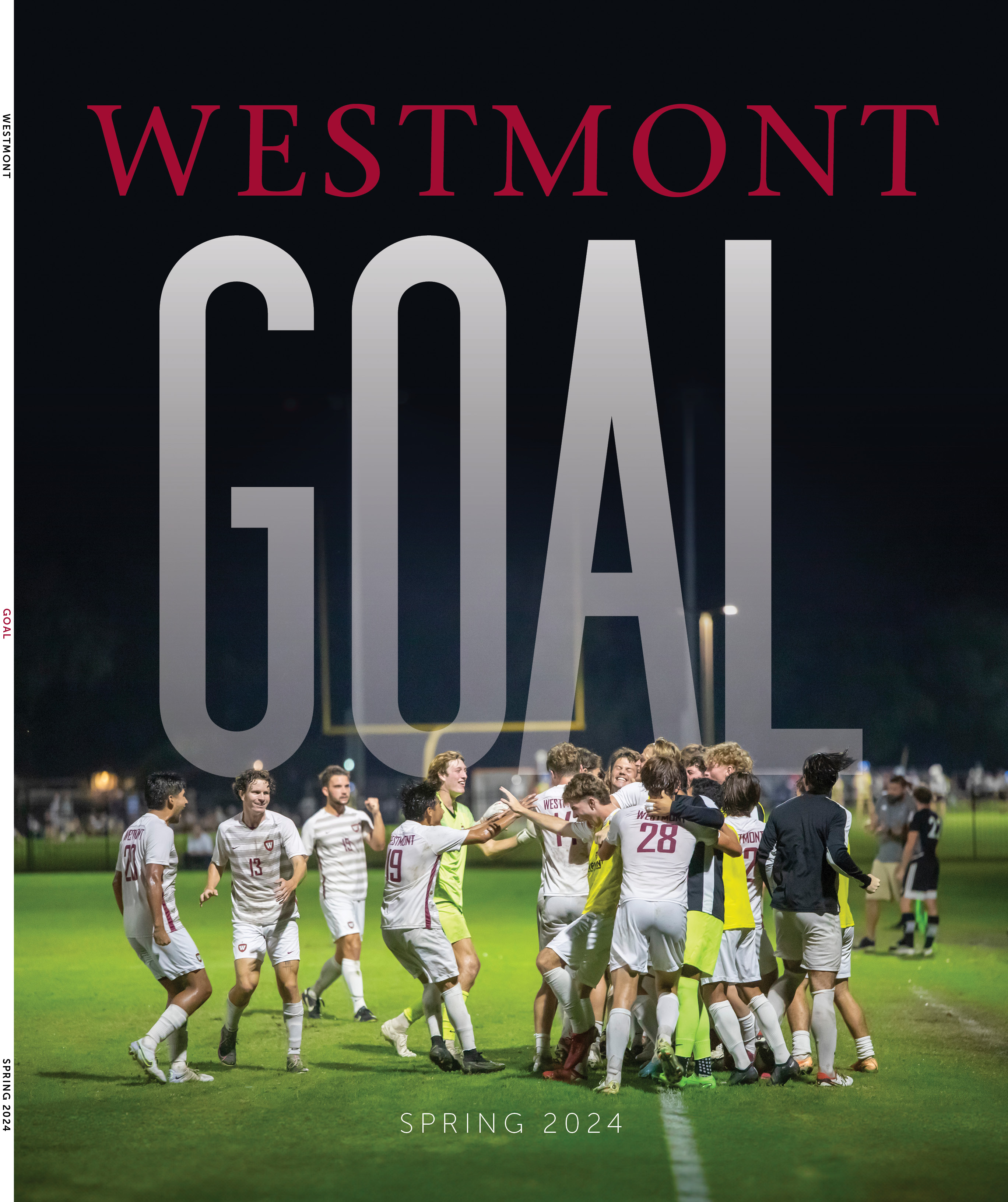

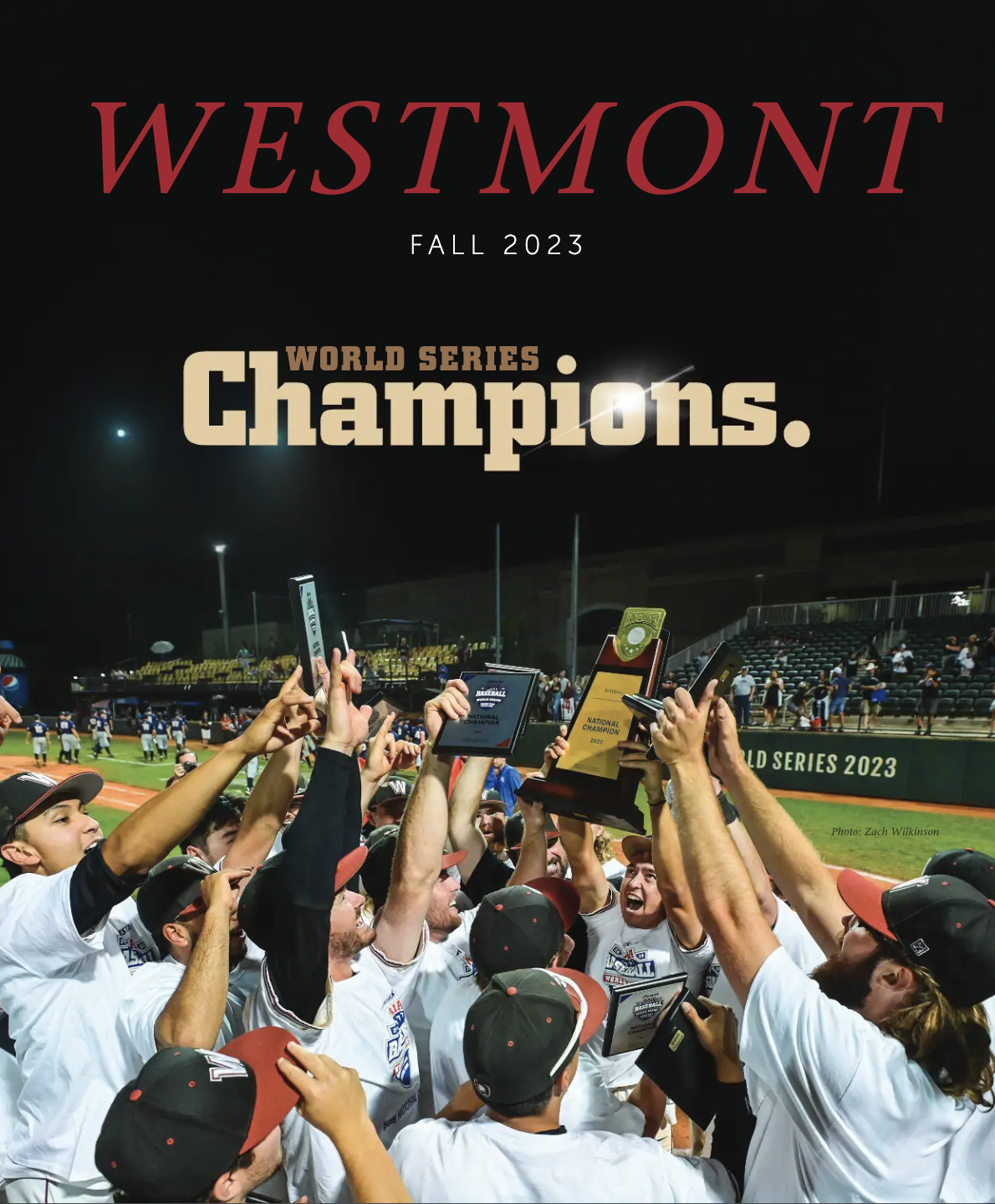

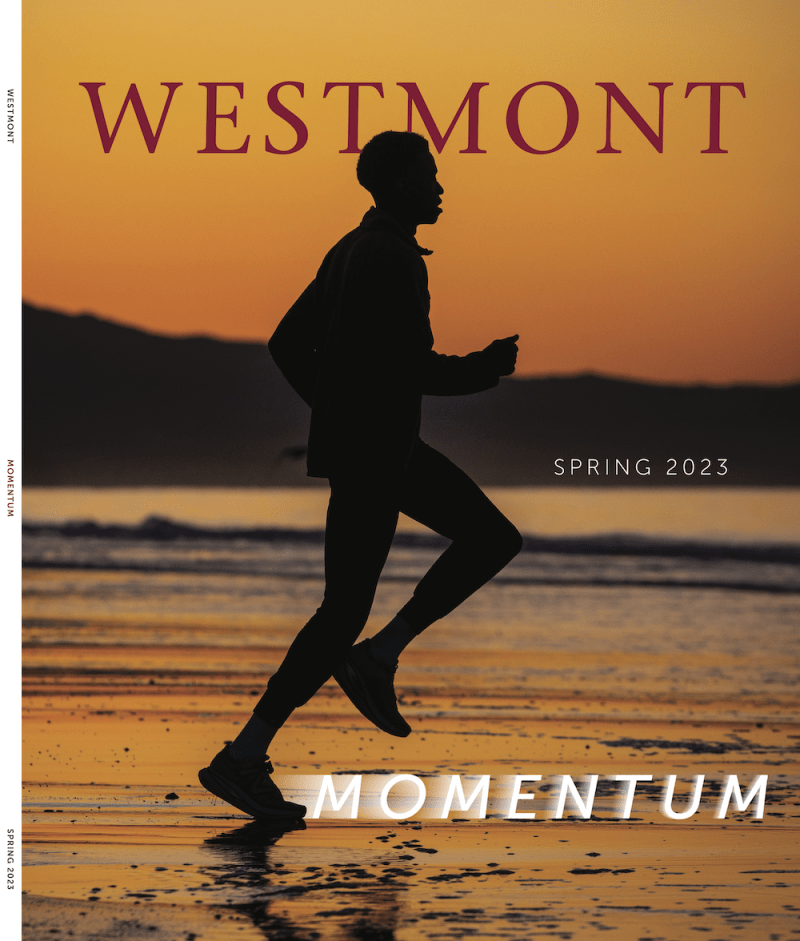

Cover Story | Athletics

“This championship is for everyone who ever wore a Westmont jersey and for the community at large."

A Westmont Soccer Story

BY JACOB NORLING

ORDER YOUR COPY TODAY!

NEWLY RELEASED! President Beebe's Newest Book

The Crucibles That Shape Us

Navigating the defining challenges of leadership.

Feature Stories

News

Westmont names the inaugural Director of the Houston Center and First Chief Diversity Officer, large grant funds study of reptile dwarfism, creative arts, AI, and other news.